Below is a comprehensive list of scams affecting Canadian citizens.

How I got scammed on Facebook Marketplace

A little while ago, I was going to buy a fridge off Facebook Marketplace. I contacted a person who had an ad for a refrigerator that was only eight months old. He asked for a deposit because he had driven to a place to drop off some items, but the person wasn’t there. So, I sent him $150.00. I needed to pay him a total of $300.00 for the fridge and for him to deliver it to me. I was thrilled to get a nearly new fridge, so I asked him if he had any other household items I was looking for. He started sending me pictures of what he had: a king-sized bed, a queen-sized bed and a mattress. A table and chairs, and maybe something else, I can’t remember. I sent him a total of $750.00. Well, he never showed up. He told me that the items were from his grandmother’s estate, and she had recently passed. I was so excited to get this stuff from his grandmother’s estate. Every time I asked about something he had, he’d send me a picture, and it always looked terrific! The next day, after I realized I had been scammed. I thought about the photos he sent me of his ‘grandmother’s’ items. I could have kicked myself. They were just random stock images. He got me good. Please read the following steps to avoid falling victim to scams, like I did.

- Never, never send any money to anyone, regardless of how sincere they are. This guy played on my emotions. His grandmother died. He had a truck full of furniture. Beautiful furniture.

- If you agree to an e-transfer, please make sure the item he sold you is at your door. Be careful. Check the item over, make sure it’s working.

- Too Good to Be True

- If a deal looks way below market value, it’s probably a scam. Scammers lure buyers with unrealistically low prices.

- Pressure to Act Fast

- Scammers often say things like “first come, first served” or “I have other buyers waiting” to rush you into making a decision without thinking.

- Requests for Payment Outside Facebook

- Never send money via wire transfer, gift cards, Venmo, Cash App, or Zelle. Use Facebook’s official checkout or pay in cash in person.

- Refusal to Meet in Person

- If the seller won’t meet locally or makes excuses (traveling, military deployment, etc.), it’s a red flag.

- Fake or Stolen Photos

- Reverse image search the photos. If you find them on other sites or listings, it’s likely a scam.

- Suspicious Profiles

- Check the seller’s profile. New accounts, few friends, or no history of Marketplace activity are warning signs.

- Overpayment Scams

- If a buyer “accidentally” sends you too much money and asks for a refund, it’s a scam. The original payment will bounce.

- Shipping Scams

- Never agree to ship items before receiving payment. Scammers may send fake shipping labels or claim to have sent payment.

- Fake Payment Confirmations

- Scammers may send fake screenshots or emails claiming they’ve paid. Always check your actual account for payment.

- Requests for Personal Information

- Never share your address, phone number, or banking info. Scammers can use this for identity theft.

- Code Verification Scams

- If someone asks you to send them a code (like a Google Voice verification), they’re trying to hijack your phone number.

- Unusual Payment Methods

- Avoid buyers or sellers who insist on using gift cards, cryptocurrency, or other non-traceable payment methods.

- Broken English or Odd Communication

- Many scam messages are poorly written or use odd phrasing. Trust your gut if something feels off.

- No-Show or Last-Minute Changes

- If a buyer or seller keeps changing the meeting location or time, or doesn’t show up, it could be a setup for a scam or worse.

- Fake Rental Listings

- Scammers post fake rental properties and ask for deposits before you see the place. Never pay before seeing a rental in person.

- Phishing Links

- Never click on links sent by buyers or sellers. They may lead to phishing sites designed to steal your info.

- Fake Facebook Support Messages

- Scammers may impersonate Facebook support, claiming your account is at risk and asking for login info.

- Check for Reviews

- If the seller has reviews, read them. Lack of reviews or all 5-star reviews from new accounts can be suspicious.

- Meet in Safe Locations

- Always meet in public, well-lit places, preferably with security cameras (like police stations or busy parking lots).

- Bring a Friend

- If possible, don’t go alone to meet a stranger for a transaction.

- Trust Your Instincts

- If anything feels off, walk away. No deal is worth risking your safety or money.

Government Impersonation Scams: Scammers pose as government officials, claiming there’s an issue with your account or that you owe money. They may ask for personal information, passwords, or money. Be cautious of unsolicited calls or messages, and never give out sensitive information.

Crypto Scams: Fraudsters promise high returns on investments in cryptocurrencies, but these are often Ponzi schemes. Be wary of guaranteed high returns, especially if they seem too good to be true.

Romance Scams: Scammers build fake relationships online, then ask for money or personal information. Be cautious of people you meet online, especially if they ask for money or financial help.

Job Scams: Scammers offer fake job opportunities, often requiring upfront payments or personal information. Be cautious of jobs that require you to pay for training or equipment.

Extortion Scams: Scammers threaten to release compromising information or videos unless you pay them. These scams often use personal information found online to make the threat more believable. Never give in to these demands, and report them to the authorities.

Phishing Scams: Scammers send fake emails or texts claiming to be from banks or other institutions, asking for login credentials or personal information. Be cautious of unsolicited messages, and never click on suspicious links or provide sensitive information.

Investment Scams: Scammers promise high returns on investments, but these are often fraudulent schemes. Be cautious of guaranteed high returns, especially if they seem too good to be true, and always research the investment thoroughly.

Spear Phishing Scams: Scammers target specific individuals or businesses with tailored phishing emails or messages. Be cautious of unsolicited messages, especially if they contain personal information or seem urgent.

QR Code Scams: Scammers use QR codes to steal personal information or money. Be cautious of QR codes sent by email or text, and never scan a QR code from an unknown source.

SIM Swapping Scams: Scammers steal your phone number by swapping your SIM card, then use your number to access your accounts. Be cautious of unexpected changes to your phone service, and report any suspicious activity to your carrier.

Fake Website Scams: Scammers create fake websites that look legitimate, offering products or services at very low prices. Be cautious of websites with poor grammar, misspelled URLs, or those that ask for payment through unusual means.

Charity Scams: Scammers pose as charities, asking for donations. Research the charity thoroughly, and never give out personal or financial information.

Home Repair Scams: Scammers offer to do home repairs at a low cost, but then demand more money or do subpar work. Always research contractors and get multiple quotes before hiring.

Investment Scams: Scammers promise high returns on investments, but these are often fraudulent schemes. Be cautious of guaranteed high returns, especially if they seem too good to be true, and always research the investment thoroughly.

Tech Support Scams: Scammers pose as tech support, claiming your computer has a virus or needs urgent maintenance. They may ask for access to your computer or payment for services. Be cautious of unsolicited calls or messages, and never give out personal or financial information.

Grandparent Scams: Scammers pose as a grandchild or a relative, claiming to be in an emergency and needing money. Be cautious of unsolicited calls or messages, and verify the identity of the caller before sending any money.

Online Shopping Scams: Scammers create fake online stores or offer products at very low prices. Be cautious of websites with poor grammar, misspelled URLs, or those that ask for payment through unusual means.

Travel Scams: Scammers offer fake travel deals or vacation packages at very low prices. Be cautious of unsolicited offers, and research the travel company thoroughly before booking.

Banking Scams: Scammers pose as bank representatives, claiming there’s an issue with your account. They may ask for personal information, passwords, or money. Be cautious of unsolicited calls or messages, and never give out sensitive information.

Utility Scams: Scammers pose as utility company representatives, claiming you owe money or need to pay for a service. Be cautious of unsolicited calls or messages, and verify the identity of the caller before making any payments.

Fake Prize Scams: Scammers claim you’ve won a prize or a contest, but you need to pay a fee to claim it. Be cautious of unsolicited messages, and never pay for a prize you didn’t enter.

Home Security Scams: Scammers offer to install home security systems at a low cost, but then demand more money or do subpar work. Always research contractors and get multiple quotes before hiring.

Moving Scams: Scammers offer to help with moving, but then demand more money or steal your belongings. Always research moving companies and get multiple quotes before hiring.

Pet Scams: Scammers offer to sell pets online, but the pets don’t exist. Be cautious of unsolicited messages, and never send money for a pet you haven’t seen in person.

Student Loan Scams: Scammers pose as government officials, claiming they can help with student loan forgiveness or consolidation. Be cautious of unsolicited calls or messages, and never give out personal or financial information.

(New!) Life Insurance Policy Scam

The New Brunswick RCMP is warning the public about a new life insurance policy scam that is currently active in New Brunswick.

Police believe that the scammers obtain information from obituaries, and a few months later, contact a family member of the deceased to notify them of a life insurance policy payout. In many cases, the scammers identify themselves by a common first name and a well-known life insurance company, and inform the relative that they are the beneficiary.

The scammer will use the information provided in the obituary to obtain more personal information. Once personal information has been obtained, it can be used to commit other frauds. For example, a scammer can create fake identity documents and apply for credit using someone else’s name and personal banking information, and disappear with the money.

“These scammers take advantage of an emotional situation to get people to share their personal information,” said Cpl Matt LeBlanc-Smith from the New Brunswick RCMP. “Please be cautious about providing any financial or personal details over the phone before confirming that it is a legitimate request from an authorized entity. One way to do this is to hang up and call the company directly.

For further information on the types of frauds and scams currently circulating and on how to best protect yourself, visit the Canadian Anti-Fraud Centre website. Please report any suspicious requests to your local detachment.

https://rcmp.ca/…/rcmp-alerting-public-new-life…

(New!) NS Power Scam

Due to the recent cyber incident, there has been an increase in fraudulent phone, text, and social media websites posing as us at Nova Scotia Power. We encourage you to remain vigilant and cautious about any unsolicited communications that appear to be from Nova Scotia Power asking you to provide your personal information.

Please avoid clicking on suspicious links or downloading attachments without confirming they are from a legitimate source. If you are unsure about the legitimacy of any communications from our team, please confirm the contact information for our Customer Care Centre here >

Spices Scam

Heads up! An online offer says, “My son works at McCormicks’ Spices and says, pending where you live, you can get a complete spice rack for $15”. Please beware – I fell for this, and it turned out to be an American company. My Canadian bank warned me of attempted fraudulent activity on my card, and I have now canceled my card. It looked and appeared so legit!

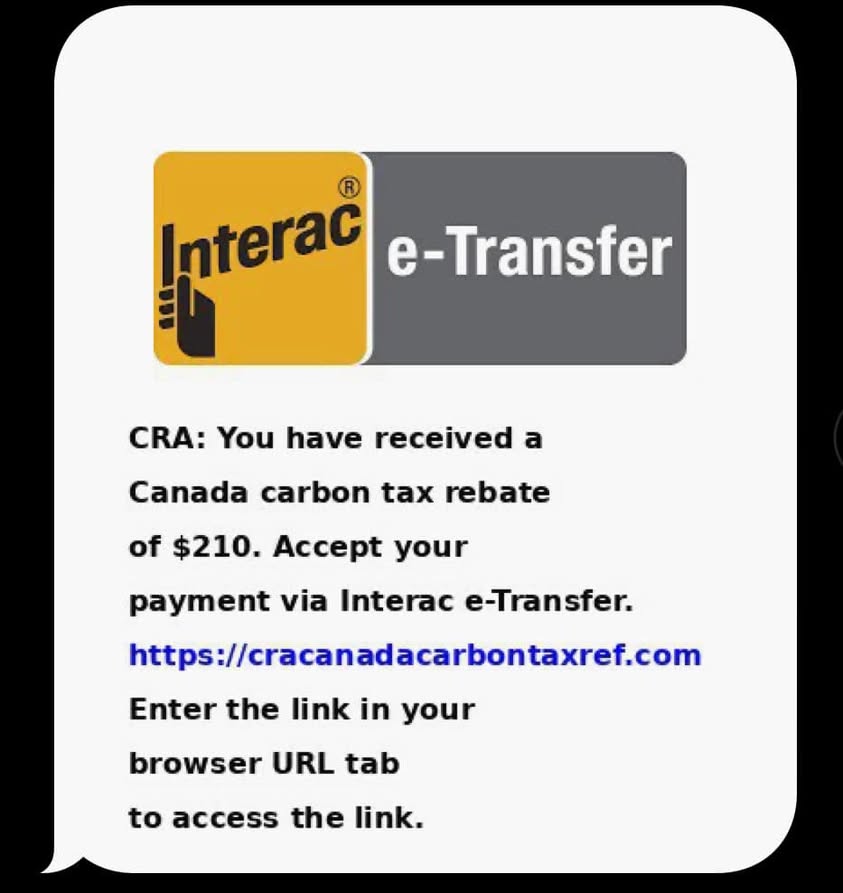

Canada Carbon Tax Rebate Scam

Hotel Scam

This is one of the best scams I’ve heard about.

You arrive at your hotel and check-in at the front desk. Typically, you give the front desk your credit card (for any charges to your room).

You go to your room and settle in. All is good.

The hotel receives a call, and the caller asks for (as an example) room 620 – which happens to be your room.

The phone rings in your room. You answer, and the person on the other end says, ‘ This is the front desk. When checking in, we encountered a problem with your charge card information. Please re-read me your credit card number and verify the last 3 digits on the reverse side of your charge card.’

Not thinking anything wrong, since the call seems to come from the front desk, you oblige.

But it is a scam by someone calling from outside the hotel.

They have asked for a random room number and then asked you for your credit card and address information.

They sound so professional that you think you are talking to the front desk.

If you ever encounter this scenario on your travels, tell the caller that you will be down to the front desk to clear up any problems. Then, go to the front desk or call directly and ask if there was a problem.

If there was none, inform the hotel manager that someone, acting like a front desk employee, tried to scam you of your credit card information.

This was sent by someone who has been duped……..and is still cleaning up the mess.

ANYONE traveling should be aware of this one!

0 Comments